Tariffs, Tough Times, and the Future of Living: A Real Estate Investor’s Take

Tariffs, Tough Times, and the Future of Living: A Real Estate Investor’s Take

Hey, real estate fam—let’s talk about the elephant in the room. The President’s been slapping tariffs on everything from lumber to steel, and it’s shaking up the housing market like a snow globe in a toddler’s hands. If you’re an investor, a flipper, or just someone trying to figure out where to park your money, you’ve probably noticed the vibes are off. Homeownership’s getting tougher, people are rethinking their moves, and honestly, the whole game feels like it’s shifting under our feet. But here’s the thing: people still need a place to live. Always will. The question is how they’re going to live—and that’s where I think we’re in for some short-term pain but a whole lot of long-term opportunity.

Tariffs Are Making Homeownership a Steeper Climb

First off, let’s break down what these tariffs are doing. When the President started throwing 25% tariffs on Canada and Mexico, then tacked on 10% for China back in February, it wasn’t just a trade war headline—it hit construction right in the gut. Lumber, gypsum, steel—you name it, the stuff we need to build homes got pricier overnight. The National Association of Home Builders pegged it at an extra $7,500 to $10,000 per house, and some analysts say it could climb to $20,000 if this drags on. That’s not pocket change when the median new home’s already hovering around $422,000.

For the average Joe or Jane trying to buy their first place, that’s a gut punch. Mortgage rates are still stubborn—hovering around 6.5% last I checked—and now you’ve got higher home prices piled on top? Ouch. It’s no wonder first-time homeowner ages are creeping up. Back in the ‘80s, the median first-time buyer was 29. Now? It’s pushing 36, and some markets like Florida are seeing folks closer to 40 before they snag keys. Affordability’s slipping through our fingers, and tariffs are just greasing the slide.

People Are Buying Less and Rehabbing More (For Now)

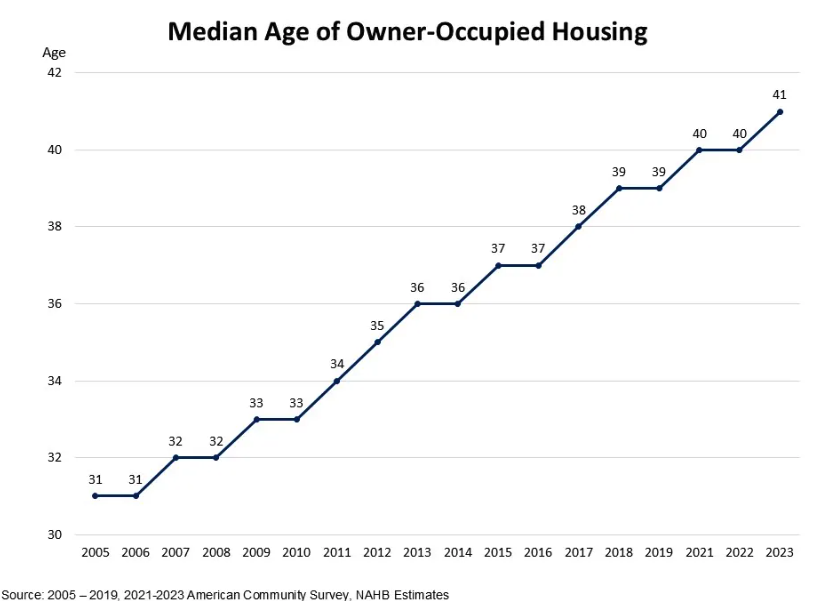

Here’s where it gets interesting for us investors. With new builds costing more, people aren’t rushing to buy fresh-off-the-line homes like they used to. Instead, they’re eyeing what’s already standing—older homes, fixer-uppers, the kind of places you can slap some paint on and call it a day. The Eye on Housing folks dropped a stat that blew my mind: almost half of owner-occupied homes in the U.S. were built before 1980. That’s a 41-year median age, up from 31 in 2005. We’re living in an aging housing stock, and new construction’s been too slow to catch up—only 3% of homes in 2023 were built in the last three years.

So what’s the play? Rehabbing. People are projected to buy less new and lean harder into renovating what’s already there. The remodeling market’s feeling it too—sentiment spiked in Q4 2024 to a solid 68 on the NAHB’s index, with big projects (think $50,000+) leading the charge. I get it—why shell out for a pricey new build when you can grab a dated ranch, gut it, and make it your own? For investors, this is gold. Flippers are licking their chops, and landlords are scooping up properties to spruce up and rent out. Short-term, this could keep the market humming while new construction catches its breath.

The Short-Term Pain Is Real

Let’s not sugarcoat it—there’s pain coming. Tariffs aren’t just jacking up material costs; they’re messing with supply chains and confidence. Builders are spooked—housing starts dropped 5.8% in 2024, per some recent data I saw. If Canada’s lumber dries up or Mexico’s gypsum gets too expensive, projects stall. Add in the labor crunch—30% of construction workers are immigrants, and mass deportations could thin that herd—and you’ve got a recipe for fewer homes hitting the market. Less supply, higher prices, rinse, repeat.

Buyers are feeling it too. Uncertainty’s a buzzkill—when stocks dip and tariff talks heat up, folks clutch their wallets tighter. Realtor.com’s Joel Berner called the market “comatose” last month, and I don’t disagree. High prices, high rates, and now this? It’s a triple whammy. For investors, that might mean slower sales or tighter margins on flips in the next 12-18 months. We’re in for a bumpy ride, no doubt.

But People Will Always Need a Roof—And That’s Where BTR Shines

Here’s the flip side: humans aren’t going to start living in caves. Demand for housing isn’t disappearing—it’s just morphing. And this is where I’m putting my chips: build-to-rent. I genuinely think BTR’s about to have its moment, and here’s why. When buying a traditional home feels like scaling Everest, renting a single-family house that feels like yours is a damn good Plan B. You get the yard, the garage, the vibe of ownership without the mortgage headache or the maintenance hassle.

The numbers back me up. Florida’s a hotbed for BTR—think Tampa, Orlando, Jacksonville—where developers are churning out rental communities faster than you can say “Sunbelt.” J.P. Morgan’s jumping in too, launching Laseter Development Group with plans for 165 homes near Atlanta and 126 in Nashville this year. Since 2020, they’ve built a $2 billion portfolio with over 6,000 rental homes. That’s not a fad—that’s a trend. Millennials want space, families want flexibility, and high home prices are pushing everyone toward renting. BTR bridges that gap beautifully.

How We Live Is Changing—And Investors Should Too

So yeah, the next year or two might sting. Higher costs, fewer builds, jittery buyers—it’s not pretty. But zoom out, and the story’s different. People will adapt. They always do. Maybe it’s rehabbing an old split-level instead of buying new. Maybe it’s renting a BTR home that feels like a forever spot without the deed. The way we make housing decisions is shifting—less “I need to own now” and more “What works for me today?”

For us investors, that’s the playbook. Short-term, I’m hunting deals on older homes—stuff I can flip or rent while the market sorts itself out. Long-term, I’m keeping an eye on BTR opportunities. Partnering with developers or snagging land in growth zones could pay off big as this trend swells. The pain’s real, but the pivot’s where the profit lives.

Wrapping It Up

Tariffs are throwing curveballs, no question. Homeownership’s tougher, first-timers are older, and new builds are taking a breather. But housing’s not dead—it’s evolving. Rehabbing’s hot, BTR’s rising, and people are rethinking what “home” means. We’ll weather the storm because we always do. The trick is staying nimble—adapt to the pain, ride the changes, and come out stronger. What’s your next move?